tti.indicators usage examples¶

Below is an example on how to use the tti.indicators package API. Accumulation Distribution Line indicator is used in this example, but similar usage applies for all the indicators. The only differences from other indicators usage are the required columns in the input data (Accumulation Distribution Line requires close, high, low and volume columns) and the different input arguments which each indicator may have.

Input data (part of them)¶

High Low close Volume

Date

1998-10-05 388.084991 342.890991 369.908997 2732524.0

1998-10-06 385.628998 371.382996 385.138000 477160.0

1998-10-07 403.313995 377.769012 398.402008 647460.0

1998-10-08 396.928009 376.295013 382.190002 292460.0

1998-10-09 394.963013 386.119995 388.084991 259155.0

Usage example¶

"""

Trading-Technical-Indicators (tti) python library

File name: indicator_example.py

Example code for the trading technical indicators, for the docs.

Accumulation Distribution Line indicator and SCMN.SW.csv data file is used.

"""

import pandas as pd

from tti.indicators import AccumulationDistributionLine

# Read data from csv file. Set the index to the correct column

# (dates column)

df = pd.read_csv('./data/SCMN.SW.csv', parse_dates=True, index_col=0)

# Create indicator

adl_indicator = AccumulationDistributionLine(input_data=df)

# Get indicator's calculated data

print('\nTechnical Indicator data:\n', adl_indicator.getTiData())

# Get indicator's value for a specific date

print('\nTechnical Indicator value at 2012-09-06:', adl_indicator.getTiValue('2012-09-06'))

# Get the most recent indicator's value

print('\nMost recent Technical Indicator value:', adl_indicator.getTiValue())

# Get signal from indicator

print('\nTechnical Indicator signal:', adl_indicator.getTiSignal())

# Show the Graph for the calculated Technical Indicator

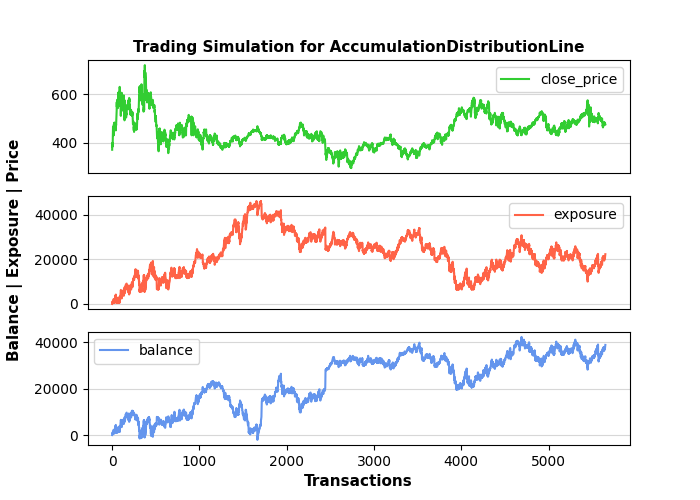

adl_indicator.getTiGraph().show()

# Save the Graph for the calculated Technical Indicator

adl_indicator.getTiGraph().savefig('./figures/example_AccumulationDistributionLine.png')

print('\nGraph for the calculated ADL indicator data, saved.')

# Execute simulation based on trading signals

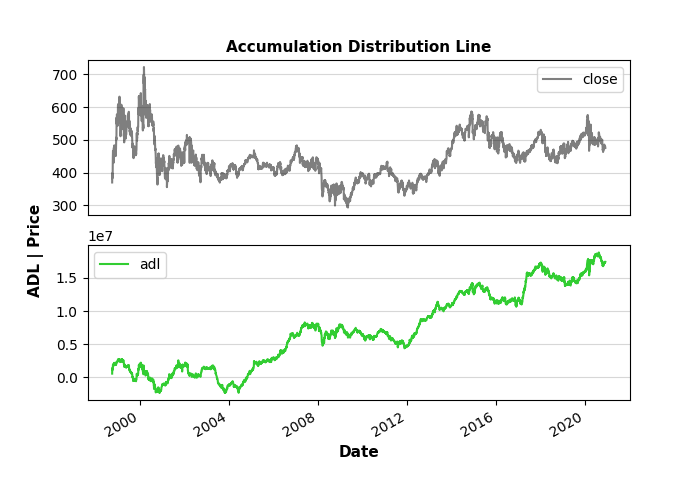

simulation_data, simulation_statistics, simulation_graph = \

adl_indicator.getTiSimulation(

close_values=df[['close']], max_exposure=None,

short_exposure_factor=1.5)

print('\nSimulation Data:\n', simulation_data)

print('\nSimulation Statistics:\n', simulation_statistics)

# Save the Graph for the executed trading signal simulation

simulation_graph.savefig('./figures/simulation_AccumulationDistributionLine.png')

print('\nGraph for the executed trading signal simulation, saved.')

Output of the above example¶

Technical Indicator data:

adl

Date

1998-10-05 5.346066e+05

1998-10-06 9.788753e+05

1998-10-07 1.377338e+06

1998-10-08 1.251994e+06

1998-10-09 1.108012e+06

... ...

2020-11-30 1.736986e+07

2020-12-01 1.741746e+07

2020-12-02 1.737860e+07

2020-12-03 1.741683e+07

2020-12-04 1.742771e+07

[5651 rows x 1 columns]

Technical Indicator value at 2012-09-06: [8617026.854250321]

Most recent Technical Indicator value: [17427706.42639293]

Technical Indicator signal: ('buy', -1)

Graph for the calculated ADL indicator data, saved.

Simulation Data:

signal open_trading_action ... earnings balance

Date ...

1998-10-05 hold none ... 0 0

1998-10-06 buy long ... 0 385.138

1998-10-07 buy long ... 13.264 411.666

1998-10-08 buy long ... 13.264 777.644

1998-10-09 buy long ... 19.159 795.329

... ... ... ... ... ...

2020-11-30 buy long ... 19817.2 37577.2

2020-12-01 hold none ... 19817.2 37577.2

2020-12-02 buy long ... 19817.2 38019.2

2020-12-03 buy long ... 19817.2 38385.1

2020-12-04 buy long ... 19817.2 38837.2

[5651 rows x 7 columns]

Simulation Statistics:

{'number_of_trading_days': 5651,

'number_of_buy_signals': 4767,

'number_of_ignored_buy_signals': 0,

'number_of_sell_signals': 601,

'number_of_ignored_sell_signals': 0,

'last_stock_value': 475.5,

'last_exposure': 22340.73,

'last_open_long_positions': 40,

'last_open_short_positions': 0,

'last_portfolio_value': 19020.0,

'last_earnings': 19817.21,

'final_balance': 38837.21}

Graph for the executed trading signal simulation, saved.

Graph output from the getTiGraph() function call.

Graph output returned by the getTiSimulation() function call.